Why the Higher Timeframe is More Important for Analysis

1. Understanding and Advantages of the Higher Timeframe

1.1 What is a Higher Timeframe?

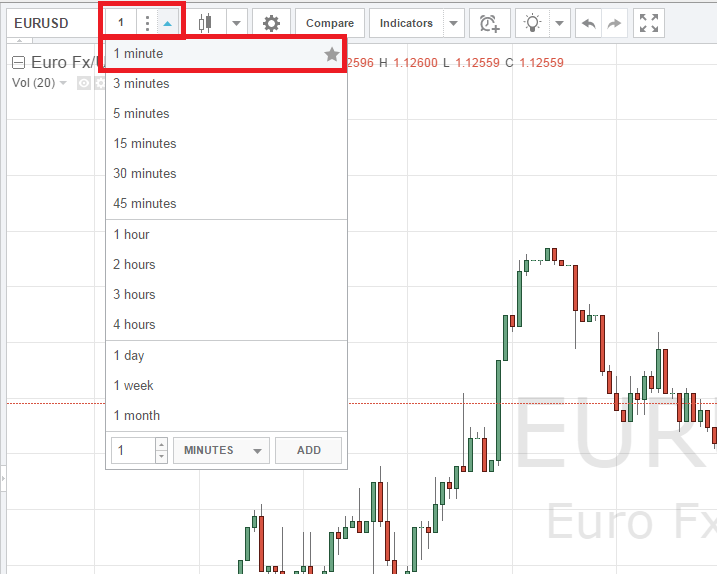

The Higher Timeframe (HTF) is a chart with a longer period, such as D1, W1, or MN. It reflects long-term trends and key areas of activity by major market participants.

1.2 A Reliable Picture of the Trend

Analysis on D1 or W1 filters out intraday noise and minor price fluctuations. This allows traders to see the primary trend and avoid false signals typical for lower timeframes.

1.3 Long-term Context

Higher timeframes take into account fundamental and macroeconomic factors that do not manifest on M15–H1. This helps in assessing the global direction and strategically planning trades.

2. Multi-Timeframe Analysis: Methodology and Practice

2.1 Key Principles

Multi-timeframe analysis starts with HTF to identify the trend and levels, then transitions to intermediate (H4–H1) and lower (M30–M5) timeframes for precise entry and trade management.

2.2 Step-by-step Approach

1. D1: Mark support and resistance levels, determine the direction of the trend.

2. H4: Look for correction patterns or bounce points.

3. M15: Refine entry timing and set stop-loss based on the structure of the lower timeframe.

2.3 Common Mistakes by Beginners

Trading exclusively on LTF without considering HTF leads to a high number of losing trades, as the trader fails to account for the overall market context.

3. Indicators and Levels on the Higher Timeframe

3.1 Moving Averages

On D1 and W1, SMA200 and EMA50 are used. The crossover of these lines signals a trend change, and the distance between them indicates the strength of the movement.

3.2 Support and Resistance Levels

Key zones are built on the extremes of weekly and monthly candles. Their breakout or bounce determines the direction for medium-term trades.

3.3 RSI and MACD

RSI on HTF identifies long-term overbought and oversold conditions, while MACD reflects changes in momentum, helping to confirm trend reversals.

4. Filtering Market Noise

4.1 Source of Noise

Lower timeframes generate noise due to orders from market makers, algorithms, and news spikes. Trading on these fluctuations without context leads to losses.

4.2 ATR as a Filter

ATR on HTF shows true volatility. If movement on LTF is less than half of the ATR on D1, such signal should be ignored.

4.3 Volume and Candlestick Patterns

Confirming an HTF signal with volume and a reliable candlestick pattern (pin bar, engulfing) increases the likelihood of success.

5. Trader Psychology and Confidence

5.1 Confidence from HTF

A signal confirmed on D1 instills calm, reduces fear and greed, and aids in making balanced decisions.

5.2 Reducing Information Overload

Focusing on higher timeframes helps avoid “analysis paralysis,” reducing the number of indicators to key ones and simplifying the decision-making process.

5.3 Discipline and Trading Plan

A clear plan: defining zones on HTF, refining entry points on LTF, and following this plan strengthens discipline and decreases emotional entries.

6. Risk Management through the Higher Timeframe

6.1 Stop-Loss Placement on HTF

Stop-loss should be set beyond a key HTF level considering ATR. This creates a reliable buffer and protects against accidental stop-outs due to noise fluctuations.

6.2 Targets and R/R

Take-profit levels are set at the next HTF levels, and R/R ratios are calculated based on long-term volatility, making targets realistic.

6.3 Filtering False Breakouts

Waiting for a D1 candle to close above or below a S/R level filters out phantom breakouts and reduces the number of losing trades.

7. Strategies Based on the Higher Timeframe

7.1 Trend Strategies

Trend-following scalping: entering during corrections on H4 and confirming momentum on D1 provides a high probability of continued movement.

7.2 Counter-Trend Approaches

Bouncing from HTF levels with a retest: a tight stop-loss and clear confirmation on H1 create attractive entry points.

7.3 Combined Signals

A MACD signal on D1 combined with a "hammer" pattern on H4 and confirmation on M30 ensures reliable entries and clearly defined stops.

8. Comparison of Higher and Lower Timeframes

8.1 Key Differences

HTF reflects the fundamental trend, while LTF shows short-term fluctuations. Trading solely on LTF often results in a high number of false entries.

8.2 Ignoring LTF Signals

If HTF indicates a sideways market or a reversal, signals on M15–H1 should be ignored to avoid trading against the primary direction.

8.3 Choosing between Long-term and Short-term Signals

Long-term signals are suited for positional trading with wider stop-losses, while short-term ones are for active traders with tight stops.

9. Real Examples and Cases

9.1 EUR/USD on D1

In January 2025, a stable upward trend formed on the daily chart of EUR/USD. Buy positions during corrections on H4 with confirmation on D1 provided traders with an average profit of 150 pips at a risk of 50 pips.

9.2 GBP/JPY in a Range

In February 2025, GBP/JPY traded within a wide sideways range on D1. Signals on M30 led to losses until traders began focusing on W1 levels; bounces from monthly extremes yielded a profit of 200 pips.

9.3 Apple Stocks on W1

On the weekly chart, Apple stocks formed a double bottom in 2024. Entries on H4 following a retest of support zones provided an R/R of 1:4 with minimal risk of stop-outs.

10. Advanced Approaches and Integrations

10.1 Fundamental Context on HTF

Incorporating macroeconomic news and corporate earnings reports into higher timeframe analysis allows consideration of the impact of fundamental drivers on long-term price dynamics.

10.2 Correlation Analysis of Instruments

Comparing the charts of correlated assets on HTF (e.g., oil and energy sector stocks) helps identify diversification opportunities and avoid simultaneous losses.

10.3 Machine Learning Models

Utilizing machine learning algorithms to analyze historical HTF data allows for the identification of hidden patterns and forecasting potential reversals or trend continuations.

10.4 Visualization and Dashboards

Interactive dashboards based on Power BI or Tableau that integrate HTF and LTF data provide traders with a cohesive view for decision-making and simplify performance tracking.

10.5 Automated Filters and Alerts

Setting alerts for breakouts of key HTF levels ensures important signals are not missed and allows for timely reactions, even when traders are occupied on lower timeframes.

Conclusion

The Higher Timeframe is the cornerstone of technical analysis. It sets the direction, filters out noise, simplifies psychology and risk management. Combined with multi-timeframe analysis, HTF enables traders to construct effective and adaptive strategies for any market and conditions, maximizing chances of success and minimizing losses.